Liquidation vs liberation day and survivor's guilt

Over my life, I have found that I see the world a bit differently than many people by virtue of having done many different things. Sometimes being different can mean that you keep certain things to yourself. So, I didn’t share that exited stocks in mid-February. But, I have some survivor guilt given the mayhem — so in this post I will offer a few quick big picture reflections and then explain some of my current investment perspectives — which is a rarity for me. That said, everyone should consult with their advisor — this is not investment advice — but I will share a bit more directly how I see the world.

Big picture reflections

- A systemic deleveraging is an evil genie that once unleashed from the bottle will rip your face off. I explained to students in my macrofinance course on Monday why Warren Buffett was smart to go all to cash. Basically, no matter how great your investments in a major deleveraging cycle other market participants who are facing liquidity issues/margin calls will sell assets with unrealized losses, weighing on your investment performance. I exited all US and foreign equities in mid-February, but stayed long some other assets consistent with my longer run macro views. In reality, it probably would have been better to go completely to cash and then come back in to those positions. These positions are coming back now, but if I had been mark-to-market (thankfully I am not) it could have been bad. Buffett understood this dynamic and that is why he is a true investing genius. Stock prices are permanently lower because earnings have been reduced for most firms. Big picture it will take awhile to get the deleveraging genie back in the bottle when the market had both US economic growth and inflation expectations heading into the tariff announcement were so wrong (people looked for a growth acceleration and inflation coming back to the Fed’s target).

- Distinguishing between in and out paradigm -- the number of people who continue to think of what is happening in markets as "in paradigm" — aka can be fit in the framework of their recent experience — is nothing short of astonishing. Investing rules of thumb that have worked well over the last 30 years may backfire as this is an utterly different macroeconomic and geopolitical environment.

60/40 or 70/30 is a serious error. Unfortunately, inflation has been above the Fed’s target for several years and is likely to become more so in light of announced tariffs. The equity/nominal bond portfolio construct only works well when inflation is near the central bank’s target which is in the process of becoming more distant.

Buying the dip in US equities at this point is also a serious error. I will only consider getting back into US equities once there is fiscal stimulus back on the table. Fiscal tightening coupled with tariffs will create liquidity shortfalls in the economy (government is withdrawing money from the economy) that can only be corrected with some fiscal breathing room/fiscal ease in H2 2025. Unfortunately, the path from where we are now to there will entail an increase in the unemployment rate that will be painful. Tariffs point to lower consumption, higher inflation, and lower living standards in the United States.

Many professional money managers look foolish here to clients. How will they explain this? They have failed their clients conventionally to paraphrase Keynes. They are hoping for a recovery — it is unlikely to happen — at what point do they capitulate and sell? Hard to say but the recognition that many asset managers are using an investment paradigm for a radically different macro environment than the one we are now in has not yet been fully absorbed.

- Stagflation is one of the worst macroeconomic environments for a central bank to face. The administration has put the Federal Reserve, commercial banks and the economy squarely into that situation with tariffs. If the government wanted lower interest rates, it could have gotten us there with a simple but effective tightening of fiscal policy without tariffs and that would have lowered inflation and slowed the US economy down and led to Fed rate cuts. Now they have put the central bank in a difficult situation with both pillars of the mandate at risk but when inflation was already above target. Worryingly, the 10-year Treasury yield has pivoted and begun to rise sharply — not fall.

- The #1 determinate of the 10-year Treasury yield is the Fed funds rate. If the government implements tariffs that increase inflation well above 3%, it is not easy/possible to bring the 10-year Treasury yield down in a normal fashion. Even if a major financial stability meltdown results in Fed rate cuts, it is plausible that the 10-year term premia rises and offsets Fed cuts. It will be a long time before I buy a nominal Treasury bond given the current inflation outlook/macroeconomic set up. I view this as an Administration policy error.

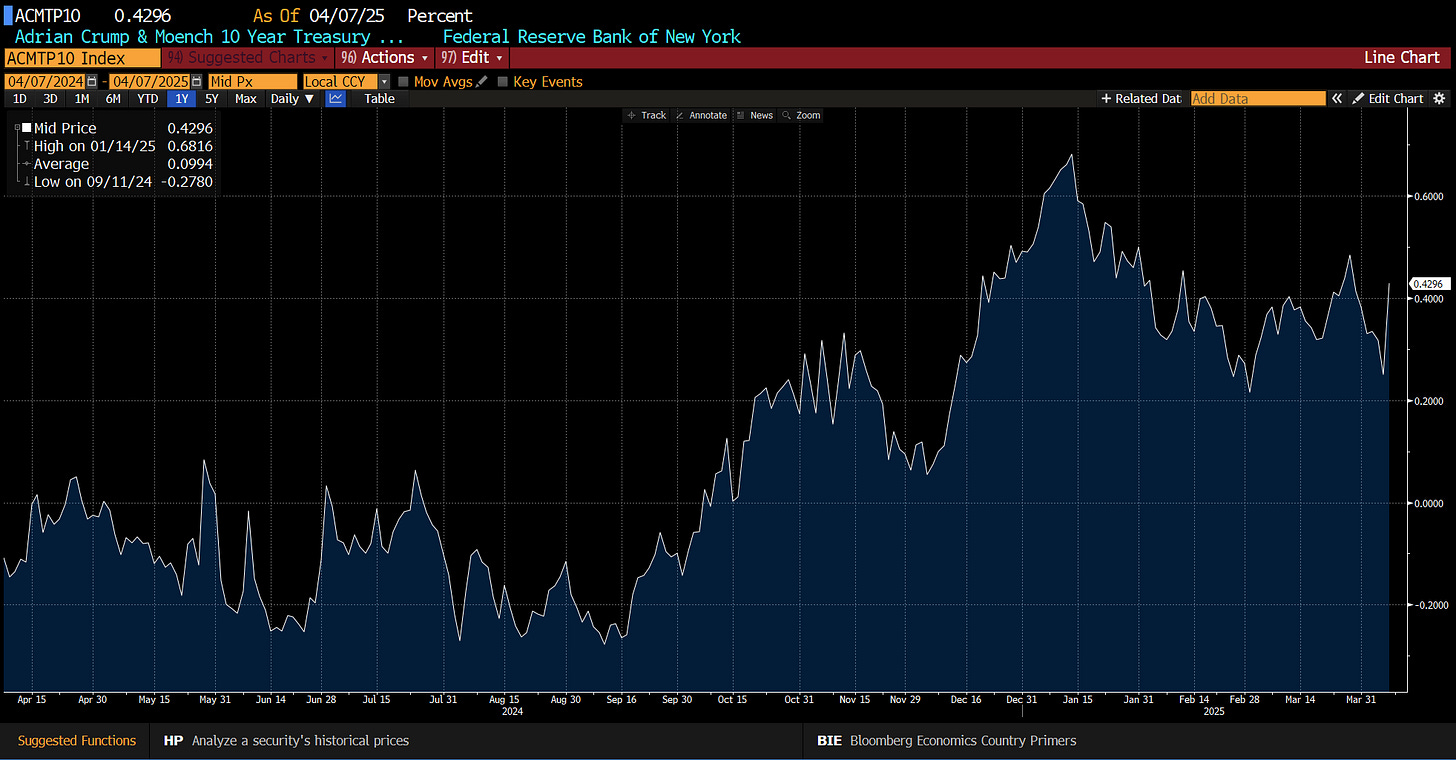

10-year Treasury term premia has begun to rise … as the deterioration in the inflation outlook and policy uncertainty outweighs the worse US growth outlook

10-year Treasury term premia got over 500 bps during the last bout of US stagflation in the 1980s.

-Unfortunately, at this juncture the Administration seems to view tariffs as part of the 2025 tax cut payfor and likely to be more permanent than many expect. In my Kobayashi Maru post from January I explained that tariffs can make it seem like tax cuts can deliver fiscal stimulus without worsening the budget deficit — the costs are borne by foreign exporters — magic! In reality, exporters are unlikely to foot the bill. De-escalation of the tariff situation with China looks remote. Investment managers who are long and wrong may be inclined to explained that tariffs will go away quickly — shade me skeptical.

- Saudi production increase was announced on the day of the tariffs. It appears to have been planned/coordinated with the administration having spoken about WTI at $50-$60. It was a truly odd attempt to temper US inflation from tariffs. I say odd because it works against the US O&G industry and pushes oil prices down to levels that will result in rising US O&G defaults and a decline in US shale production. How does increased dependency of foreign oil help the US trade balance or US national security? I am not seeing it. Seems like a major policy misstep in a world where geopolitical risks are rising. Hopefully, some fellow Texans begin to speak up more … silence is consent.

-Yen carry trade unwind -- the notable strengthening of the yen this morning (up two big figures today) suggests that an unwind is happening, implying further increases in US corporate bonds yields and declines in the NASDAQ. The unwind of the yen carry trade in 2008 was an accelerant to problems. I wrote about the yen carry trade previously in M-FAB … it has begun.

- Unwind of the Treasury basis trade — banks need to conserve their balance sheet given market volatility and the decline in their share prices, raising their market implied default probabilities. They are less inclined to fund the basis trade contributing to upward pressure on US Treasury yields in addition to the stagflation problem. We have succeeded in encouraging investors like central banks and others with stable funding to leave the Treasury market and incremental Treasury funding is coming from hedge funds who are mark-to-market sensitive and use leverage from banks. A levered bond portfolio — which is what the basis trade is — results in meaningful duration extension, increasing overall risk. The government debt stock is growing too fast relative to the growth of private sector balance sheets with stable funding.

- Vaclav Havel, a dissident and later president of Czechoslovakia after the fall of the Berlin Wall, said that “ideology is a specious way of relating to the world. It offers human beings the illusion of an identity, of dignity, and of morality while making it easier for them to part with them.” I think Havel’s statement is correct and brilliant. It also could be extended to thinking ideologically about investing — it is a great way to be parted from your money. One of the ways of being successful in these times is to be analytic and think critically — not ideologically — even if and especially when critical analysis lead you to a conclusion that you don’t like.

So on investments — what am I thinking about?

I expect higher inflation, a weaker dollar and typical investment portfolios to perform poorly.